An accountant is vital to ensuring your organization maintains accurate financial statements and records. Operating a business without strong bookkeeping is like driving a race car with a blindfold on. You can’t measure your progress—and you could very well end up in a wreck if the IRS decides to audit you. With so much at stake, you have to recruit, hire, and train the right candidate. You can’t afford to make a mistake.

Accountants must have business acumen, excellent organizational skills, and a strong aversion to risk. If they work in a client-facing role, whether with large firms or small business owners, they’ll also need people skills. That’s because they’ll likely be providing financial advice over the phone or in person. Accountants must be trustworthy, highly precise, and great with numbers. Finding all those qualities in one individual is a tall order. To meet your business goals, you need to have the right person for the job.

The hard part about hiring for this role is that less extraverted candidates might have trouble “selling themselves” during the interview so you might not get a good sense of how truly capable they are. And if your company is high-growth, you need an accountant who can work at a fast pace while maintaining accuracy—but it’s hard to get a sense of how fast someone works based on their resume.

It’s tempting to make a quick decision based on a resume when you’re desperate to fill an empty seat. But it’s dangerous to rely on resumes and gut feel when it comes to hiring.

When you cross your fingers and hope for the best, you increase the chance of making a bad hire. Here’s why:

The traits that matter most aren’t on a resume.

The soft skills that make an accountant great don’t tend to show up on a resume. Most accountants come with aptitude in all the expected accounting software and skills, and some are highly-skilled Certified Public Accountants (CPAs). But ethics and trustworthiness can’t be easily evaluated on paper without falling back on gut instinct. Because of this, hiring decisions may feel like leaps of faith or an over-reliance on instinct.

According to the BLS, the job outlook for accountants and auditors will grow 10 percent by 2026. As the economy and U.S. businesses grow, you might end up hiring for multiple open roles over the next few years. This means you need to learn to hire well so you can bring the right people on board.

So how can you hire accountants who are likely to be high-performing? Here are four ways to start:

1. Rely less on resumes and look to behaviors.

It’s not hard to find accountants with the ideal set of “must-have” industry skills and proficiencies. But once you get past the ability to use spreadsheets and crunch numbers, the qualities that really distinguish a stand-out candidate are behavioral. Are they trustworthy, creative, and organized? Are they a great team player? Can they explain complicated concepts in a simple way? Do they love puzzles? Will they keep looking until they find a solution to a problem? These are the candidates you want to find. But to uncover behavioral traits, you need to look beyond the resume.

Your first step is to identify the must-have behavioral traits your accountant needs to succeed.

Think beyond proficiencies. It helps if auditors have a good “bedside manner” so they can better investigate without putting people on guard. Because of digital transformation, accountants need to be creative enough to offer fresh ideas and strategies. Depending on the business, they might need client-facing skills, and the drive to master new developments in their field.

Most teams look for:

- Organization

- Risk aversion

- Precision

- Warmth

- Creativity

- Drive to learn

Sit down with the rest of the hiring team and decide what behavioral traits matter most. For example, you don’t want to hire someone who lacks precision. If they don’t enjoy crossing their Ts and dotting their Is, they’d be miserable in the role.

2. Define the raw skills the accountant role requires.

List out the raw skills your desired candidate should have to be highly successful in the job. Unlike someone’s innate behavioral drives, which tend to stay the same throughout time, the majority of skills can be taught. Are you willing to teach someone on the job? If so you can hire a less seasoned professional. But if your company is moving at a rapid pace, you need someone experienced who can dive right in.

Accountants need to be good communicators. Depending on the day they may have to act as arbiter, educator, or referee. Don’t forget to list out these soft skills in addition to your hard skills. In terms of raw skills, candidates should:

- Be business-savvy.

- Communicate clearly.

- Have financial aptitude.

- Solve problems creatively.

- Be analytical.

- Know how to examine financial records.

Having a bachelor’s degree in accounting or a related field is a must for most organizations, but do you want to see an advanced degree or a CPA license? Figure it out and document it all. If you don’t do this early work you could end up making the wrong hire, because you didn’t take the time to map out the role and get on the same page with the rest of your hiring team.

3. Use smarter processes to sort candidates.

At The Predictive Index®, we recommend that hiring managers create a Job Target. This is a profile you can build by completing a quick survey. Job Targets isolate the behavioral traits and cognitive ability someone needs to be successful in a role.

Ask applicants to take a behavioral assessment and a cognitive assessment. You can then compare results to the Job Target you created to help decide which candidates to bring in for an interview.

Our PI Behavioral Assessment™ is scientifically validated and can be used to uncover candidates’ innate behavioral drives, which manifest as workplace behaviors. After someone takes the assessment, we assign them one of 17 Reference Profiles. These help ensure job fit, which is a key component of employee engagement and productivity.

Our PI Cognitive Assessment™ is a tool hiring managers can use to measure candidates’ ability to learn new information. As accountants have a cognitively complex role, you want to make sure you hire someone whose score falls within the range you set when you created your Job Target. If someone lacks the cognitive ability needed for success, they will end up miserable. And the last thing you want your employees to be is miserable.

When you make science a part of your recruiting process, it’s easier to identify candidates who are likely to be a great fit for the job.

In summary, hiring managers should screen for behavioral fit and cognitive fit in addition to must-have skills.

4. Don’t be deceived by your own biases.

Research has shown that even the most impartial managers can be victims of unconscious biases when making hiring decisions. Using quantitative methods—such as a behavioral assessment—is the best way to uncover less obvious skills like creative problem-solving, organization, or risk aversion.

Sample interview questions to ask an accountant candidate

To find the right accountant, you need to ask the right questions. Here are some sample interview questions you can use to confirm a person’s behavioral fit for the role (or investigate areas of misalignment):

- Do you believe rules are meant to be broken? Why or why not?

- Tell me about a time you experienced conflict on a team. What was the resolution?

- Have you ever been faced with a seemingly insurmountable problem? How did you tackle it?

- Can you describe a time you had to flag potential risk? Walk me through the thought process and learnings.

- In your mind, what do you think makes for a good accountant?

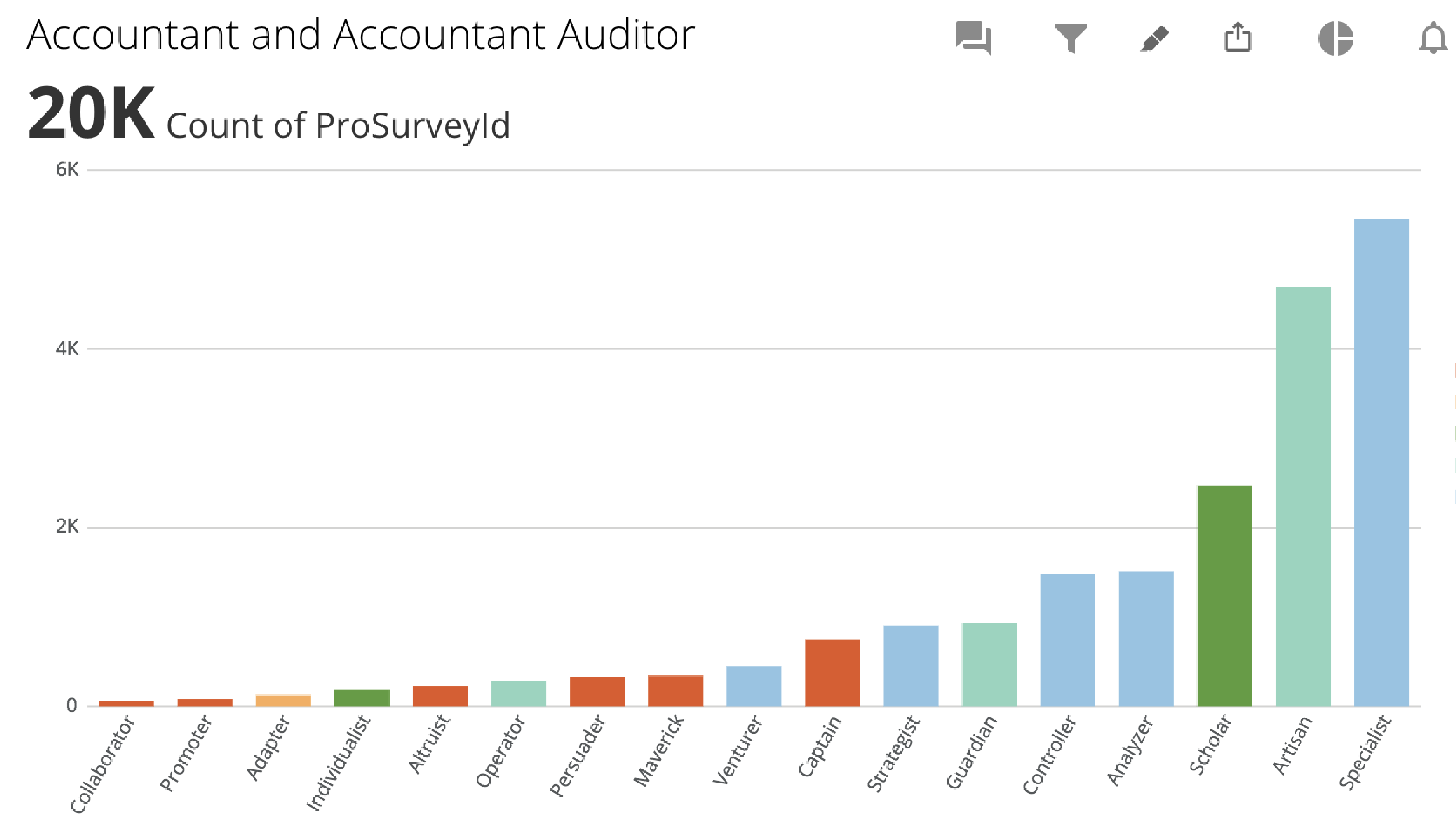

3 most common Reference Profiles for accountants

When we look at the more than 20,000 Job Targets companies have set for accounting roles, we found that a majority of hiring teams look for these three Reference Profiles:

Specialist

The Reference Profile that shows up most often is Specialist. This is not a surprise, as Specialists are analytical and all about precision. Their masterful attention to detail makes them a strong choice for this exacting role. They are comfortable working at a fast pace as long as they have clear rules and structure in place. They aren’t loud and chatty extraverts—instead they listen carefully and speak thoughtfully. These risk-averse professionals have strong discipline and execution. They’re excellent at following established guidelines and holding others to high standards. Conservative and careful, Specialists are a trustworthy addition to any organization.

Artisan

An Artisan is an ideal candidate for accounting roles within organizations that are going through change or digital transformation. Steady and reliable, they are highly detailed and precise about their work. Unlike the Reference Profiles with a high dominance drive, Artisan profiles don’t feel the need to push their ideas on others. Instead, they are collaborative. They thrive in a stable work environment, but they also enjoy helping to create new structure and rules. If you need to bring someone on board to design processes and guidelines, this stabilizing profile could be a great choice. Like Specialists, Artisans are cautious and reliable, as well as risk-averse.

Scholar

If your accounting role is heavy on auditing and problem-solving, you might be well-served by a Scholar. Words to describe this Reference Profile include persistent, dogged, and disciplined. Scholars like to work independently in a stable, consistent environment. They dislike being micromanaged, as they know they can be relied upon to see to all the details themselves, without oversight. Despite their imaginative approach to analysis, their work is thorough, methodical, and “by the book.” Like Specialists and Artisans, Scholars are highly cautious practitioners who will always be on the lookout to protect you from risk.

Though all three of these Reference Profiles are reserved and exacting, they come at their work from different points of view. Specialists fall into what we call the analytical group of Reference Profiles, and they’re more comfortable working at a fast pace. Artisans are the most low key and accommodating of the three groups, falling into the stabilizing group of profiles. Scholars, as part of the persistent group of profiles, are far more concerned with tasks than people and enjoy working alone, while the other two like to collaborate. There’s no best choice—it all depends on your organizational culture and needs.

How The Predictive Index helps companies hire top performing accountants

Of course, it’s not always clear cut what your business needs to thrive—especially when it comes to hiring. If hiring decisions were easy, recruiters would never whiff on a job ad, managers would never mishire, and organizations would hum at peak efficiency.

Sounds like a dream, doesn’t it?

While nothing short of a crystal ball could get your hiring accuracy to 100 percent, The Predictive Index gives you the next best thing. Use PI to align on an accountant’s job requirements with key stakeholders in your organization. From the CFO, to existing high-performers in the role, use PI to analyze what exactly you’ll need to land a stellar accountant.

After agreeing on a job description, use PI to create a Job Target for the role. As applicants roll in, see how their behavioral traits and cognitive ability stack up to the benchmarks you’ve set. Use PI’s Interview Guide to hone in on the right candidates—and make the right hire for your organization.

Join 10,000 companies solving the most complex people problems with PI.

Hire the right people, inspire their best work, design dream teams, and sustain engagement for the long haul.

How to attract top-performing accountants

Artisan and Scholar profiles are likely to stay put where they are as they thrive in a stable environment. None of the three Reference Profiles are social butterflies—they don’t enjoy networking events or floating from company to company. Here are a few tips on how to find and attract Specialist, Artisan, and Scholar profiles to your company:

Check your employer brand.

All three of these types are careful and cautious. Before they apply to a new position you can bet they’ll check your company culture and credentials as closely as you’re checking theirs. Be sure you’re using language in your ads that will resonate with them, and assure them you have the sort of accountable, rules-based environment they prefer.

Try to get a referral.

These Reference Profiles often tend to stay where they are comfortable—for years or even decades. If they do start looking for a new opportunity, they tend to get snapped up fast. Keep your job listings up to date and organized, in case they stop by your website.

In most cases, the easiest way to find a new accountant is through referrals—people who have worked with them in the past, and were impressed with their precision and reliability. Leverage your existing employees and your own network to see if anyone knows of someone like this who would be a good fit for your company, and then get your ducks in a row to impress them.

Think beyond proficiencies.

If you want to find candidates with the behavioral and cognitive traits to succeed in your organization, you need to know what those traits actually are. Proficiencies and software skills are just table stakes if you’re searching for the right accountant. You’ll ensure a better fit if you think beyond skills to the underlying behavioral needs of the role.

Do you need a problem-solver who can ferret out issues in your books? Are you a fast-paced, high-growth environment that needs someone to work quickly with careful by-the-book execution? Or do you need a more collaborative accountant who can provide advice to others? The better you can communicate this through job listings, the better your odds of attracting the right fit.

Hang on to them.

You worked hard to hire them, so be sure you give them the tools they need to be successful in their work. Help them to understand their own Reference Profile, and how they can work most successfully in your organization. Make sure you develop solid career paths for your accountants—whether they want to move up the ladder or grow in their individual contributor role.

Don’t leave hiring to chance. Try our free Job Benchmarking Calculator to discover the most common Reference Profiles for any position in your company.

FAQ

Why hire an accountant?

- Gain an expert in financial planning to support the CFO.

- Maintain strong bookkeeping and a well-documented cash flow.

- File tax returns and ensure compliance with tax laws.

- Build financial acumen within a small business or startup.

- Refine existing financial processes in a larger organization.

What are the types/variations of the accountant position?

- Business accountant

- Accounts receivable specialist

- Accounts payable specialist

- Financial advisor

What skills and qualities make for a high-performing accountant?

- Ability to read and analyze financial reports

- Excellent record keeping skills

- Well-versed in tax planning.

- Knowledge of QuickBooks or equivalent accounting software

- Prior experience in accounting services, or at an accounting firm